reverse tax calculator bc

Reverse Sales Tax Formula Calculates the canada reverse sales taxes HST GST and PST Tax Amount Original Cost - Original Cost 100 100 GST or HST or PST Amount without Tax Amount with Taxes - Tax Amount. It is very easy to use it.

Most goods and services are charged both taxes with a number of exceptions.

. Now you can find out with our Reverse Sales Tax Calculator Our Reverse Sales Tax Calculator accepts two inputs. This will give you the items pre-tax cost. On January 01 1991 goods and services tax GST was introduced in Australia.

This simple pst calculator will help to calculate pst or reverse pst. We can not guarantee its accuracy. It is easy to calculate GST inclusive and exclusive prices.

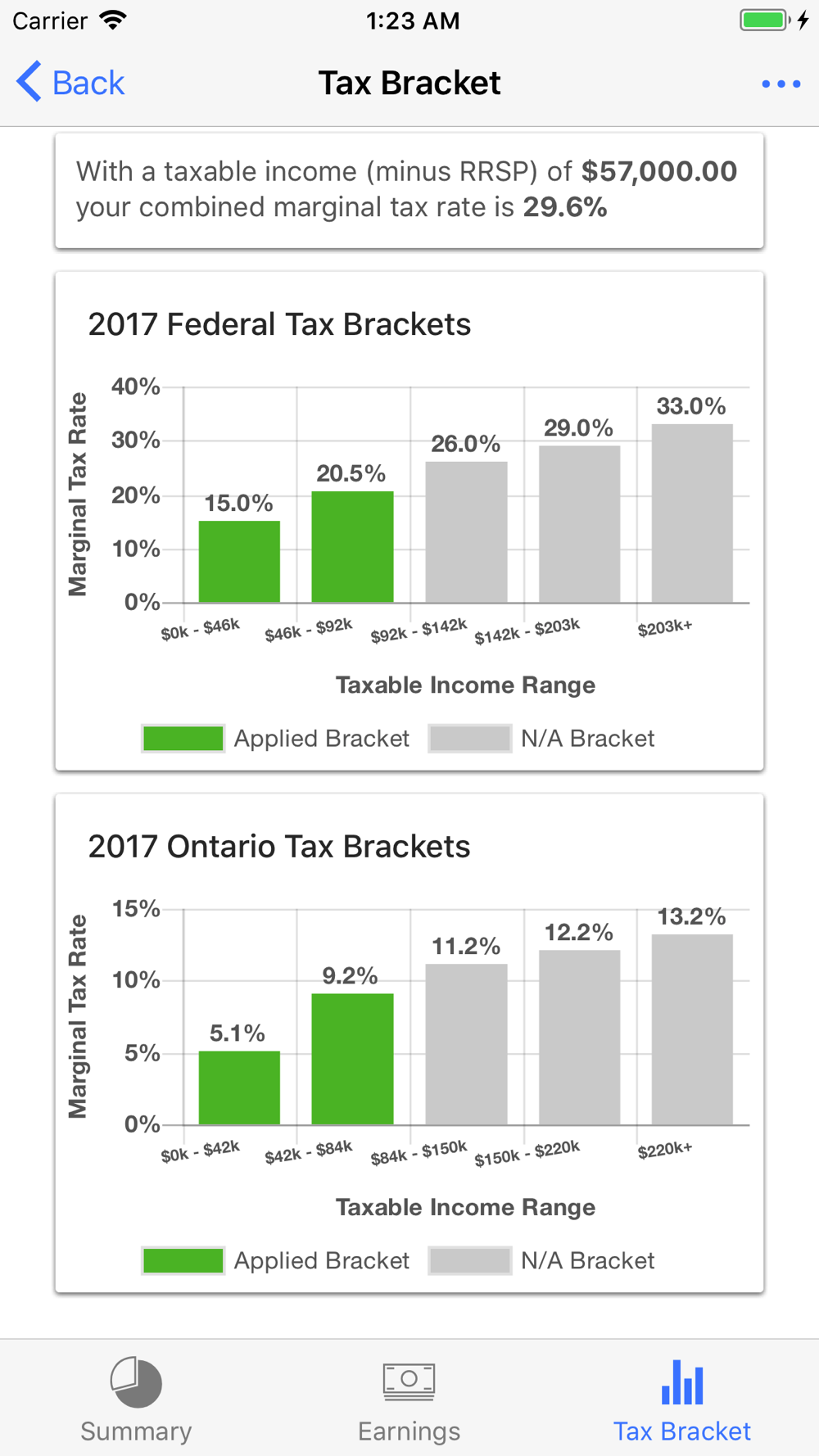

Each province has their own set of tax brackets which can differ from the federal tax brackets. You will then go to Screen 3 which shows the individual tax rates selected the total tax rate the assessed value input and. Originally called the Property Purchase Tax the PPT was first introduced in 1987 as a wealth tax to discourage speculation and cost 1 of the first 200000 and 2 of the remainder although 95 of home purchases did not qualify for the tax at the time as they were below the 200000 mark.

After-tax income is your total income net of federal tax provincial tax and payroll tax. Selling Price Final Price 1 Sales Tax Reverse Sales Tax Definition Have you ever wondered how much you paid for an item before the sales tax or if the sales tax on your receipt was correct. Current Provincial Sales Tax PST rates are.

Select the appropriate tax rates for the desired service area and property class by clicking on the box to the right. This will combine the GST and PST and you can enter the amount to then reverse it out. History of the Property Transfer Tax.

This calculator should not be considered a substitute for professional accounting or legal advice. The Provincial Sales Tax PST applies only to three provinces in Canada. Who the supply is made to to learn about who may not pay the GSTHST.

The reverse sales tax calculator exactly as you see it above is 100 free for you to use. Subtract the price of. Hst reverse sales tax calculation or the harmonized reverse sales tax calculator of 2021 for the entire canada ontario british columbia nova scotia newfoundland and labrador and many more canadian provinces If you make 52000 a year living in the region of british columbia canada you will be taxed 10804.

Reverse Sales Tax Formula. When was GST introduced in Canada. British Columbia Manitoba Québec and Saskatchewan.

The basic personal tax amount CPPQPP QPIP and EI premiums and the Canada employment amount. The second tab lets you calculate the taxes from a grand total including tax and gives you the subtotal before tax. British Columbia is one of the provinces in Canada that charges separate 7 Provincial Sales Tax PST and 5 federal Goods and Services Tax GST.

Useful for figuring out sales taxes if you sell products with tax included or if you want to extract tax amounts from grand totals. Type of supply learn about what supplies are taxable or not. This is any monetary amount you receive as salary wages commissions bonuses tips gratuities and honoraria payments given for professional services This amount is either 18 of your earned income in the previous year or.

This will give you the items pre-tax cost. Harmonized Sales Tax HST The Harmonized Sales Tax or HST is a sales tax that is applied to most goods and services in a number of Canadian provinces. Sales Taxes in British Columbia.

Federal Revenues from Sales Taxes. When all the rates have been selected click on any of the Calculate buttons to the right of the table. It ranges from 13 in Ontario to 15 in other provinces and is composed of a provincial tax and a.

If you want a reverse GST PST calculator BC only just set the calculator above for British Columbia and it will back out the 12 combined tax rate for the amount you enter in. See the article. Amount with taxes Canada Province HSTQSTPST variable rates Amount without tax Current HST GST and PST rates table of 2022 On March 23 2017 the Saskatchewan PST as raised from 5 to 6.

The BC homebuyer tax calculator application is a free service offered by the British Columbia Real Estate Association. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax Amount without sales tax GST rate GST amount Amount without sales tax QST rate QST amount Margin of error for sales tax An error margin of 001 may appear in reverse calculator of sales tax. Tax rate for all canadian remain the same as in 2017.

Only four Canadian provinces have PST Provincial Sales Tax. Reverse GSTPST Calculator After Tax Amount. What is GST rate in Canada.

The following table provides the GST and HST provincial rates since July 1 2010. GSTPST Calculator Before Tax Amount. Where the supply is made learn about the place of supply rules.

Provinces and Territories with GST. New brunswick income tax calculator. It can be used as well to reverse calculate Goods and Services tax calculator.

The rate you will charge depends on different factors see. This simple PST calculator will help to calculate PST or reverse PST. New Brunswick Newfoundland and Labrador Nova Scotia Ontario and Prince Edward Island.

Calculate GST with this simple and quick Canadian GST calculator. These calculations are approximate and include the following non-refundable tax credits. British Columbia Provincial.

The following table provides the GST and HST provincial rates since July 1 2010. Northwest territories nunavut and yukon have no territorial sales tax at all. In Québec it is called QST.

Formula for calculating reverse GST and PST in BC. Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. The information used to make the tax and exemption calculations is accurate as of January 30 2019.

Harmonized reverse sale tax calculation for all the provinces of Canada. Amount with sales tax 1 gst and qst rate combined100 or 114975 amount without sales tax. To calculate the total amount and sales taxes from a.

Rates are up to date as of June 22 2021. Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund.

Pst Calculator Calculatorscanada Ca

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

Canada Sales Tax Gst Hst Calculator Wowa Ca

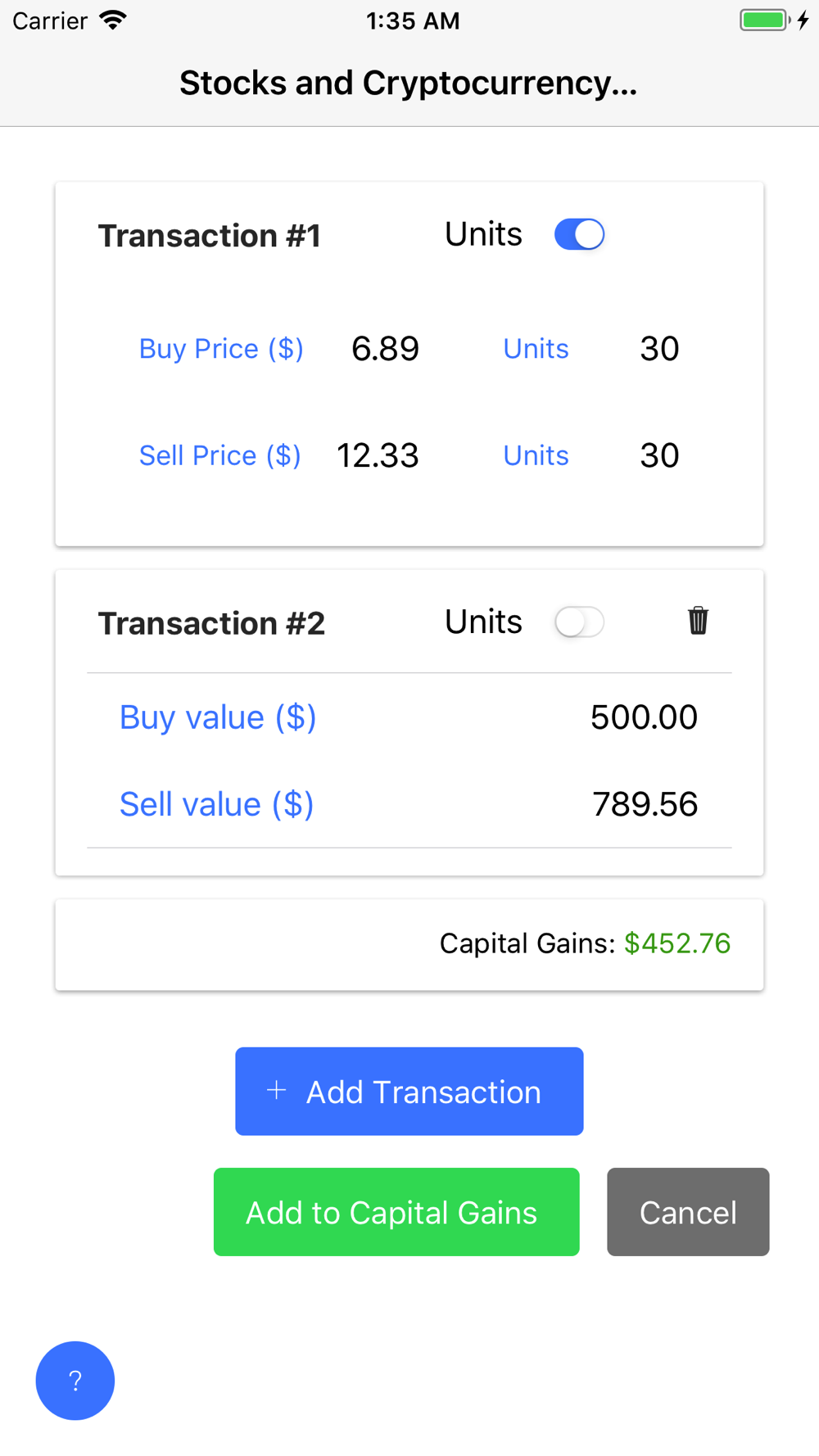

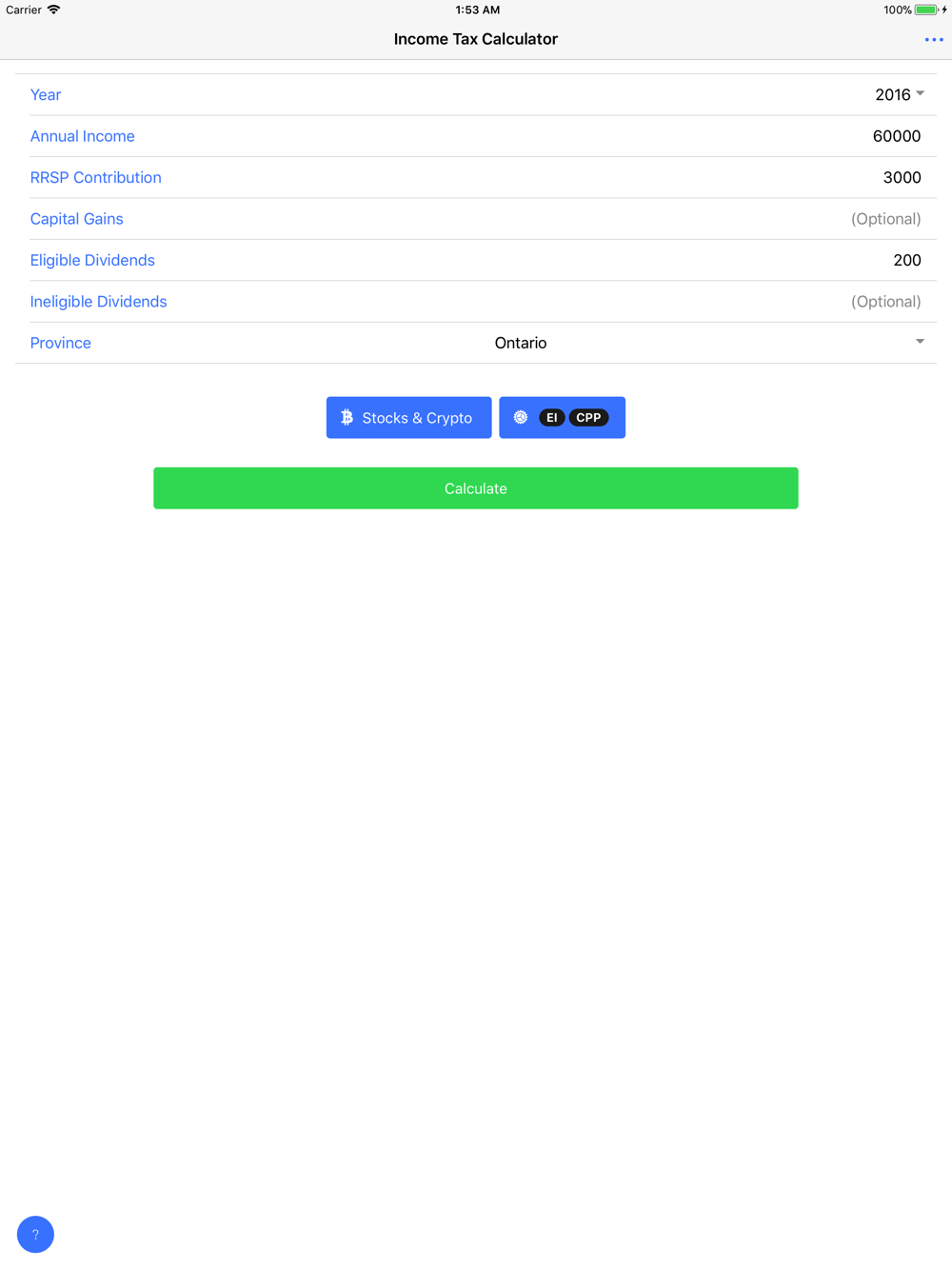

Canada Income Tax Calculator Free Download App For Iphone Steprimo Com

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

Canada Income Tax Calculator Free Download App For Iphone Steprimo Com

Adding A Reverse Mortgage To Your Nest Egg Strategy Marketwatch Reverse Mortgage Mortgage Refinance Calculator Refinance Mortgage

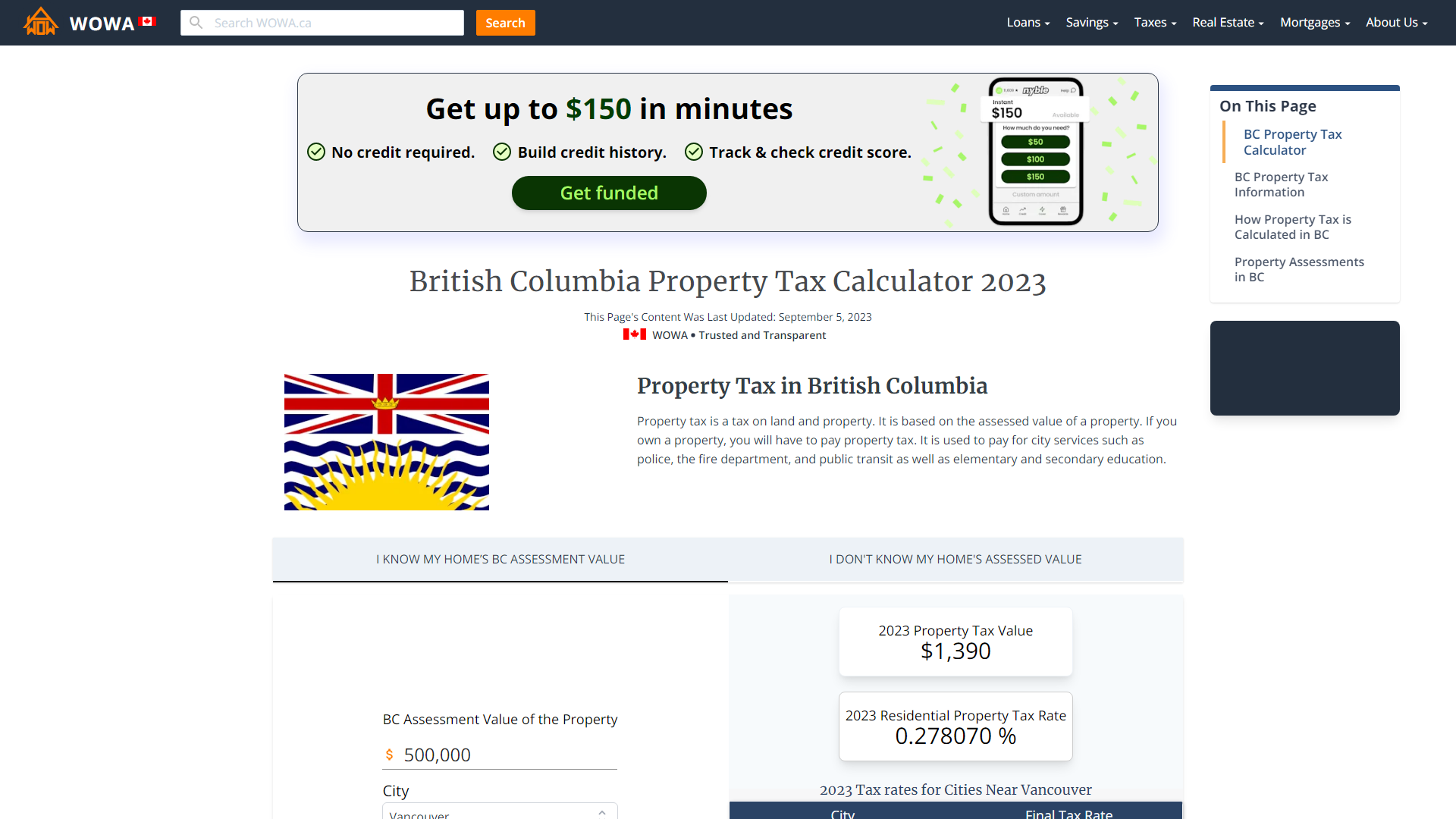

British Columbia Property Tax Rates Calculator Wowa Ca

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

Land Transfer Tax And Cmhc Calculators For Your Website Ratehub Ca

Saskatchewan Gst Calculator Gstcalculator Ca

Canada Income Tax Calculator Free Download App For Iphone Steprimo Com

2021 2022 Income Tax Calculator Canada Wowa Ca

Cool Tools Hp 35s Scientific Calculator Scientific Calculator Scientific Calculators Calculator

Reverse Hst Calculator Hstcalculator Ca

Ashworth A02 Lesson 8 Exam Attempt 1 Answers Exam Lesson Mortgage Payoff